Make a difference in your employees’ lives with Texas ABLE®, a tax-advantaged savings plan for Texans with disabilities.

64% of caregiver employees and 63% of employees with disabilities agree that ABLE accounts would be an important employer benefit.

What is Texas ABLE?

The Texas Achieving a Better Life Experience (“Texas ABLE®”) Program is a tax-advantaged program that helps eligible Texans with disabilities and their families save for qualified disability expenses while maintaining eligibility for certain means-tested federal and state benefits, such as Supplemental Security Income (SSI) and Medicaid. Eligible individuals can save for long-term goals, such as a mobility van or education; for everyday expenses, such as medical bills or groceries; or for long-term care for a loved one.

Why is Texas ABLE Important to My Employees?

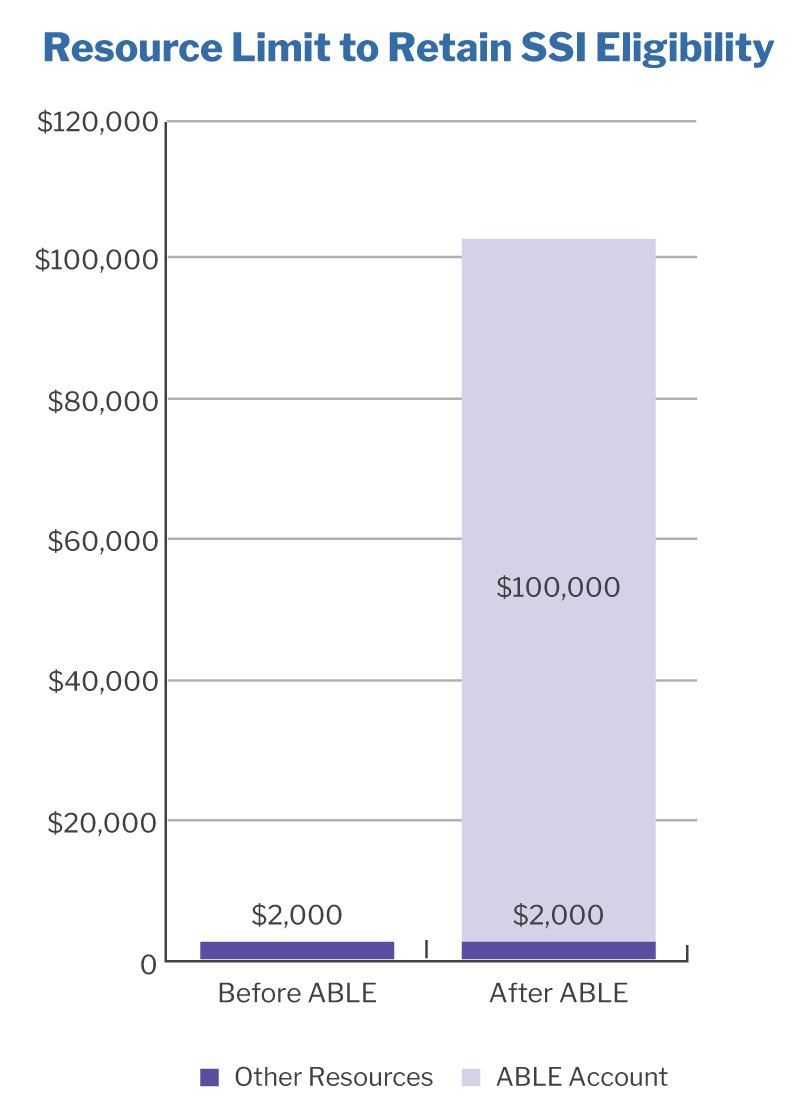

According to the U.S. Bureau of Labor Statistics, almost one in five persons with disabilities was employed in 2021. The U.S. Department of Health and Human Services’ 2017 report, Caregiver Resources & Long-Term Care, notes that one in five U.S. employees identifies as a caregiver for an aging, seriously ill, or disabled family member or friend. Before ABLE, individuals with disabilities who had $2,000 or more in resources would lose eligibility for critical means-tested government benefits. With a Texas ABLE account, participants can save up to $100,000 in an ABLE account in addition to the $2,000 prior resource limit without impacting benefit eligibility, or they can save up to $500,000 in a Texas ABLE account if SSI eligibility is not a consideration.

Why is Texas ABLE Important to My Company?

According to researchers at Harvard Business School, 73% of employees in the U.S. are caring for a child, parent or friend. Companies face a growing yet largely undetected threat to their workers’ productivity, employee retention and, ultimately, competitive advantage: the needs of employees who are caregivers.

A 2018 Accenture report shows that companies tend to see overall improvements in employee loyalty, leading to increased employee retention, financial performance and productivity when companies meet the needs of employees with disabilities and their caregivers. — Getting to Equal: The Disability Inclusion Advantage

We Make Texas ABLE Participation Easy

You can make a difference in the lives of your employees by helping them save for their children’s or grandchildren’s future education. You can be a leader as a company that recognizes and prioritizes the needs of your employees and their families and helps foster the educated workforce necessary for the future economic growth of Texas and your company.

Here are a few ways we can help:

- Produce and distribute informational materials

- Conduct webinars

- Make in-person or virtual presentations

- Provide articles for your employee newsletter or internal website

- Host informational tables at your employee events and/or benefit fairs

Contact the Texas ABLE Program Outreach Team to learn more.

Email TexasABLE@cpa.texas.gov or call 800-531-5441, ext. 5-5331.

Compliance code: 1 2 3 5, NLD, Feb 16, 2023