Help your clients learn about saving for a loved one’s disability expenses.

They could be eligible to save for qualified disability expenses without impacting benefit eligibility.

What is Texas ABLE?

The Texas Achieving a Better Life Experience (“Texas ABLE®”) Program is a tax-advantaged program that helps eligible Texans with disabilities and their families save for qualified disability expenses while maintaining eligibility for certain means-tested federal and state benefits, such as Supplemental Security Income (SSI) and Medicaid. Eligible individuals can save for long-term goals, such as a mobility van or education; for everyday expenses, such as medical bills or groceries; or for long-term care for a loved one.

What important plan details should I know about?

- Texas residents with a qualifying disability present prior to the age of 26 may enroll.

- An eligible individual at least 18 years of age can open and manage his or her own account, or an authorized legal representative may open and manage the account for the beneficiary according to the following hierarchy: agent under a Power of Attorney, legal guardian or conservator, spouse, parent, brother or sister, grandparent, or representative payee appointed by the SSA.

- Participants can save up to $18,000 per year.

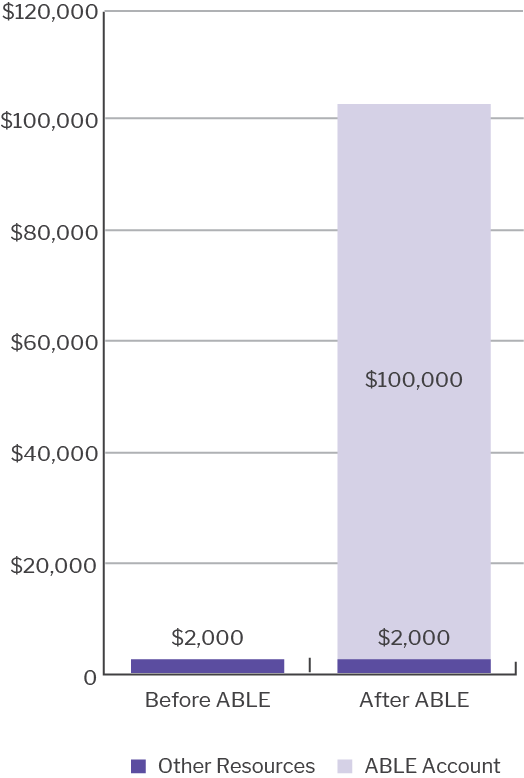

- Participants can save up to $100,000 in an ABLE account without impacting SSI benefits or save up to the account balance limit of $500,000 if benefit eligibility is not a consideration. While funds of more than $100,000 in an ABLE account will be treated as a countable resource for SSI determination purposes, funds in the account don’t count toward the individual’s eligibility for Medicaid.

- Anyone can contribute to the account, including the eligible individual, family, friends, organizations and even a special needs trust.

- Withdrawals from the account, including earnings, are federal income tax free if used to pay for qualified disability expenses.

- Federal regulations for ABLE accounts allow federal tax-free rollovers from 529 college savings accounts to an ABLE account. Certain limitations apply.

- Participants can conveniently use the U.S. Bank® Focus Card – the program’s prepaid debit card – for qualified disability expenses anywhere nationwide that accepts Visa® debit cards.

- Open for enrollment year round.

With ABLE, individuals can now have up to $102,000 in resources without losing eligibility for SSI.

Help your clients plan for their loved one’s futures today.

Contact the Texas ABLE Program Outreach Team to learn more.

Email TexasABLE@cpa.texas.gov or call 800-531-5441, ext. 5-5331.

Compliance code: 1 2 3 6, NLD, Feb 16, 2023